🚀 Fastest way to get a loan without selling your shares

🚀 Fastest way to get a loan

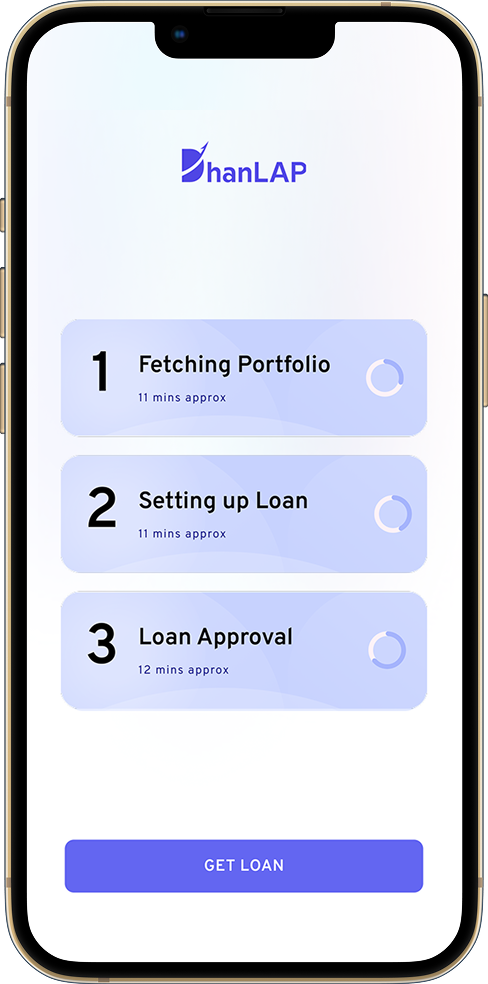

Download our app or Signup with your

email and mobile number in web.

One time online verification using your PAN

& Aadhaar details

Select the shares to pledge

Pledge your shares at NSDL

Verify you bank account and setup

emandate

Our agent will verify your details via

video call

Digitaly sign loan agreement with OTP

authentication

Overdraft or Immediate disbursal whatever

you apt for you will recieve your money

within that day.

You should be between 18 and 65 years of age

You should be between 18 and 65 years of age

Your entire share portfolio should not be less than ₹50,000

Your entire share portfolio should not be less than ₹50,000

The collateral value of any 1 share shouldn't exceed 50% of the total collateral amount.

The collateral value of any 1 share shouldn't exceed 50% of the total collateral amount.

You should have a Demat account with NSDL.

You should have a Demat account with NSDL.

Minimum of 3 shares should be pledged.

Minimum of 3 shares should be pledged.

Joint holders are not eligible for a loan

Joint holders are not eligible for a loan

You should be an Indian resident

You should be an Indian resident

A Loan Against Shares (LAS) is a flexible funding solution that lets you pledge your existing share portfolio instead of selling it. With DhanLAP, you can access up to ₹5 crore instantly while continuing to enjoy potential market gains and dividends.

A Loan Against Shares (LAS) is a smart and flexible solution for those who want access to liquidity without disrupting their long-term investment goals. Here are some of the most common real-life scenarios where individuals and business owners choose to avail LAS:

Fund new projects, stock purchases, vendor payments, or seasonal expenses — while keeping your equity holdings intact.

“LAS from DhanLAP helped me scale operations without touching my investments — truly seamless.” - Says Rajesh Mehta, Mumbai

“LAS from DhanLAP helped me scale operations without touching my investments — truly seamless.” - Says Rajesh Mehta, Mumbai

Fund higher education abroad or professional courses without interrupting your market exposure.

Get funds without selling shares at an unfavourable price.

“Markets were down, but I needed money urgently. I pledged my equity mutual funds instead of selling them at a loss.” - Says Sunil Sharma

“Markets were down, but I needed money urgently. I pledged my equity mutual funds instead of selling them at a loss.” - Says Sunil Sharma

Stay invested and ride out volatility instead of locking in losses.

At 12% p.a., LAS can be a smarter alternative to high-interest loans and credit cards.

“I was paying 36% on my credit card. I replaced it with a 12% loan against shares. It was a game-changer.” - Says Ravi Kumar

“I was paying 36% on my credit card. I replaced it with a 12% loan against shares. It was a game-changer.” - Says Ravi Kumar

Don’t just take our word for it — here’s what real users have to say about their experience with LAS:

“I used LAS from DhanLAP to fund my daughter’s education abroad. The process was entirely online, and I had the money in my account the same day without selling a single share.”

“When my business needed quick working capital, LAS helped me unlock ₹10 lakh from my portfolio without disturbing my long-term investments.”

DhanLAP accepts shares from a lender-approved list that is updated monthly. This includes actively traded companies from sectors such as Banking, IT, FMCG, Pharma, and Energy. Customers can check the full list in our FAQs.