🚀 Fastest way to get a loan without selling your mutual funds

🚀 Fastest way to get a loan

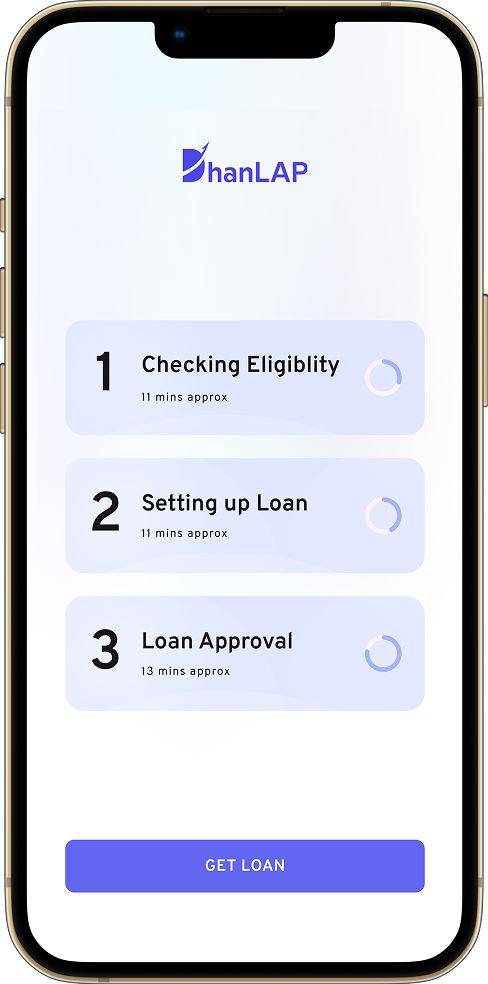

Fully Digital Process

Fully Digital Process

Best Interest Rate

Best Interest Rate

Get Instant disbursal to your Bank Account

Get Instant disbursal to your Bank Account

Retain Ownership

Retain Ownership

Download our app or Signup with your

email and mobile number in web.

One time online verification using your PAN

& Aadhaar details

Select the Mutual Funds to Pledge.

Verify you bank account and setup

emandate

Our agent will verify your details via

video call

Pledge your funds at CAMS &

KFINTECH RTAs

Digitaly sign loan agreement with OTP

authentication

Overdraft or Immediate disbursal whatever

you apt for you will recieve your money

within that day.

You should be between 18 and 65 years of age

You should be between 18 and 65 years of age

Your entire portfolio should not be less than ₹50,000

Your entire portfolio should not be less than ₹50,000

Joint holders are not eligible for a loan

Joint holders are not eligible for a loan

You should be an Indian resident

You should be an Indian resident

You should be between 18 and 65 years of age

You should be between 18 and 65 years of age

Your entire portfolio should not be less than ₹50,000

Your entire portfolio should not be less than ₹50,000

Joint holders are not eligible for a loan

Joint holders are not eligible for a loan

You should be an Indian resident

You should be an Indian resident

(By prepaying your Installments can be reduced)

(By prepaying your Installments can be reduced)

A Loan Against Securities (LASec) is a flexible funding solution that lets you pledge your existing investments — such as mutual funds, shares, ETFs, and bonds — instead of selling them. With DhanLAP, you can unlock liquidity while continuing to earn returns on your holdings.

A Loan Against Securities (LASec) is a smart and flexible solution for those who want access to liquidity without disrupting their long-term investment goals. Here are some of the most common real-life scenarios where individuals and business owners choose to avail LASec:

Fund new projects, stock purchases, or seasonal expenses — while keeping your investment portfolio intact.

Access instant cash without liquidating investments at unfavourable prices.

Fund higher education abroad or professional courses without selling your long-term assets.

Ride out market fluctuations and avoid locking in losses.

Replace high-interest loans with a single, lower-cost facility.

Don’t just take our word for it — here’s what real users have to say about their experience with LASec:

"I pledged my mutual funds and shares to raise funds for my business expansion — got the money the same day and didn’t have to sell a single investment."

"LASec helped me meet my son’s tuition fee overseas without disturbing my equity portfolio. Smooth and fully online."

“LASec is perfect for professionals like me with variable cash flows. I use the overdraft when needed and pay interest only on the amount I use. It’s like having financial freedom on standby.”

DhanLAP accepts a wide range of securities from lender-approved lists, including: