With Loan against Mutual Fund, you offer your MF units as collateral for the loan. The lender holds the Mutual Fund units as a security till you repay the loan amount. Your Mutual Funds will continue to earn returns, but you cannot sell them while you have pledged them to the lender.

1. Aadhar number

2. PAN number

3. Bank account number

4. IFSC code

5. You also need to have access to the mobile number associated with your Aadhar and bank account.

Yes, you can lien mark any equity mutual fund units of your choice in your mutual fund portfolio. We will show you an optimal allocation for lien marking depending on your portfolio and loan amount that you had asked for. You can change the schemes and units and have your own allocation for lien marking. We are completely flexible with it.

Once you repay your full loan amount, your funds will be unlienmarked in 2-3 Business days.

We support all mutual funds across all Asset Management Companies (AMCs) for loans, except for locked-in units in Equity Linked Savings Scheme (ELSS) funds.

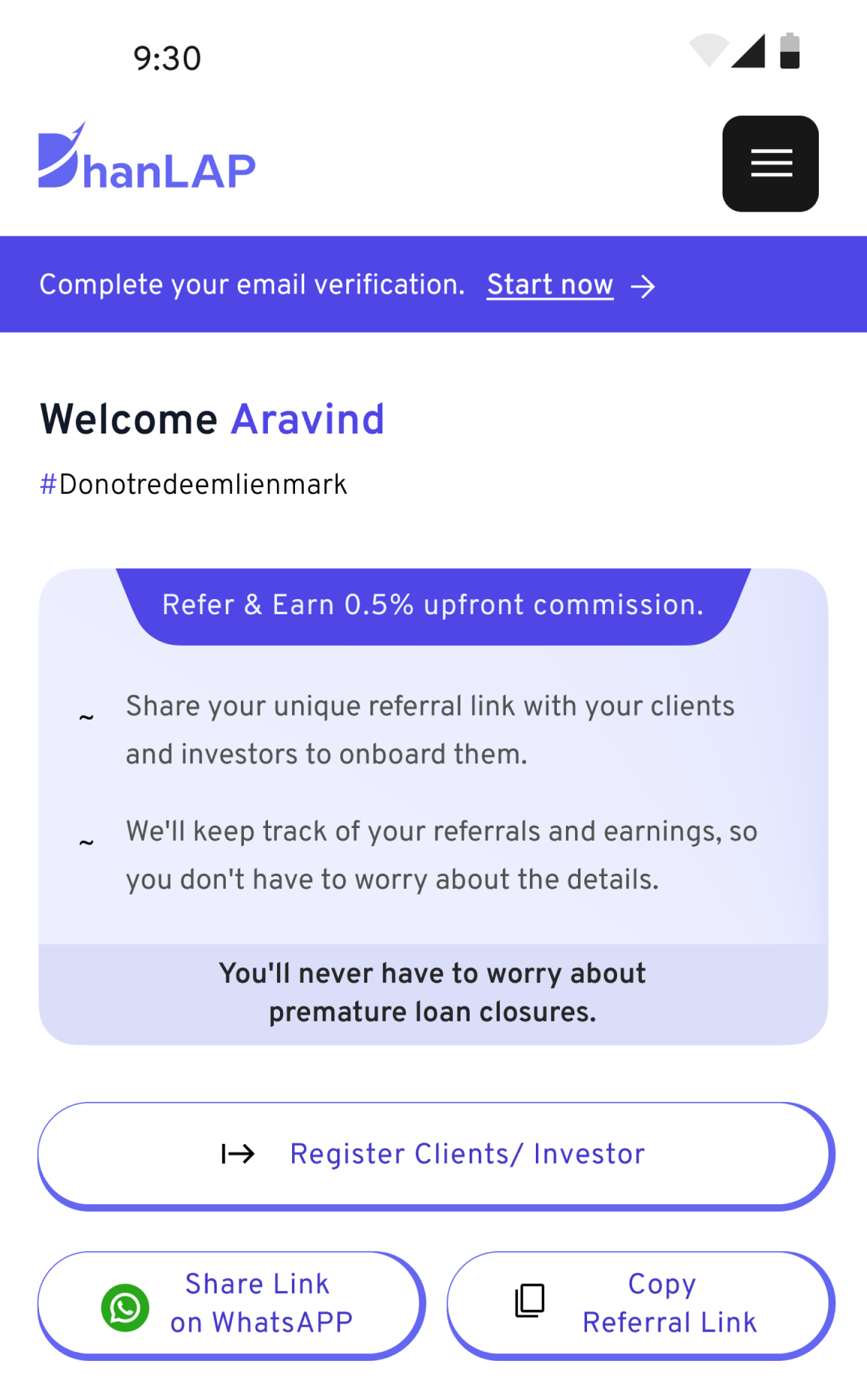

When you take a loan against your mutual fund units, we pledge your mutual fund units, so that it cannot be redeemed until you pay back the loan. The lien marking is done digitally and in real-time.

You can change your email/mobile number though MFCentral

You can sign up at MFCentral and put a service request.

MFCentral will update the email/mobile number on your behalf within 1-2 days