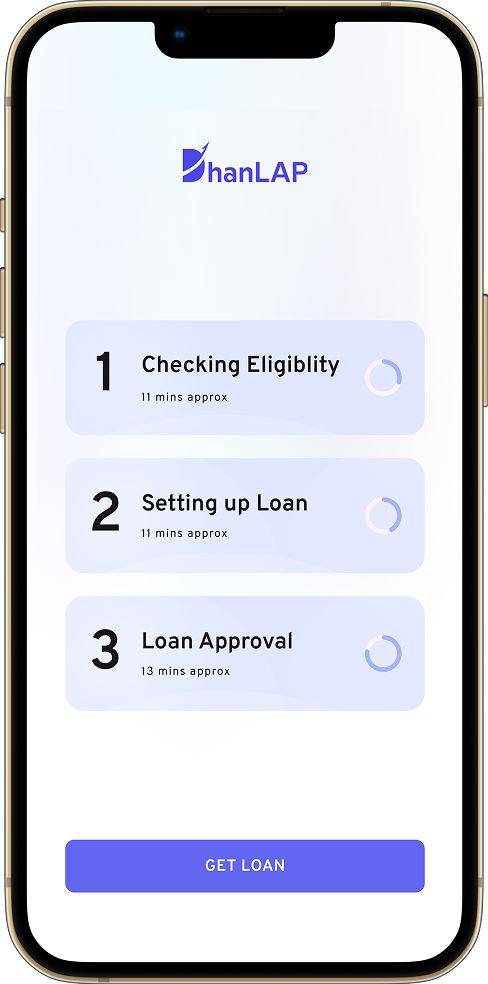

🚀 Fastest way to get a loan without selling your mutual funds

🚀 Fastest way to get a loan

Download our app or Signup with your

email and mobile number in web.

One time online verification using your PAN

& Aadhaar details

Select the Mutual Funds to Pledge.

Verify you bank account and setup

emandate

Our agent will verify your details via

video call

Pledge your funds at CAMS &

KFINTECH RTAs

Digitaly sign loan agreement with OTP

authentication

Overdraft or Immediate disbursal whatever

you apt for you will recieve your money

within that day.

You should be between 18 and 75 years of age

You should be between 18 and 75 years of age

Your entire mutual fund portfolio should not be less than ₹50,000

Your entire mutual fund portfolio should not be less than ₹50,000

You should hold Mutual Funds approved with CAMS & Kfintech (RTAs). ELSS funds are not eligible.

You should hold Mutual Funds approved with CAMS & Kfintech (RTAs). ELSS funds are not eligible.

Joint mutual fund holders are not eligible for loan

Joint mutual fund holders are not eligible for loan

You should be an Indian resident

You should be an Indian resident

A Loan Against Mutual Funds (LAMF) is a smart, secured borrowing option where you pledge your existing mutual fund units instead of redeeming them. This allows you to unlock liquidity while your investments continue to grow.

A Loan Against Mutual Funds (LAMF) is a smart and flexible solution for those who want access to liquidity without disrupting their long-term investment goals. Here are some of the most common real-life scenarios where individuals and business owners choose to avail LAMF:

Entrepreneurs often use LAMF to fund short-term working capital gaps, vendor payments, or even business expansion — all without disturbing their equity or debt fund investments.

“Instead of going through long documentation for a business loan, I pledged my mutual funds and got an overdraft limit the same day.” - Says Deepankar

“Instead of going through long documentation for a business loan, I pledged my mutual funds and got an overdraft limit the same day.” - Says Deepankar

Health emergencies require quick access to funds. With LAMF, you don’t have to redeem long-term mutual fund holdings or break FDs at a penalty — just pledge and access funds instantly.

Many investors avoid redeeming during market corrections, as doing so locks in losses. LAMF allows you to meet financial needs while keeping your investments intact and ready to recover.

“Markets were down, but I needed money urgently. I pledged my equity mutual funds instead of selling them at a loss.” - Says Sunil Sharma

“Markets were down, but I needed money urgently. I pledged my equity mutual funds instead of selling them at a loss.” - Says Sunil Sharma

Whether it's a home renovation, destination wedding, or higher education fees, LAMF can act as a bridge loan without putting long-term plans at risk.

Instead of paying high interest on credit card dues or personal loans, many users pledge mutual funds to get a much lower interest rate on their loan — saving money in the process.

“I was paying 36% on my credit card. I replaced it with a 10% loan against mutual funds. It was a game-changer.” - Says Ravi Kumar

“I was paying 36% on my credit card. I replaced it with a 10% loan against mutual funds. It was a game-changer.” - Says Ravi Kumar

Don’t just take our word for it — here’s what real users have to say about their experience with LAMF:

“I needed ₹5 lakhs urgently for bulk inventory purchase. Instead of applying for a new loan, I pledged my mutual funds and got an overdraft facility the same day. No need to disturb my SIPs or go through lengthy paperwork.”

“I had to arrange funds for an emergency surgery in my clinic. LAMF helped me access ₹8 lakhs in less than 24 hours, without liquidating my investment portfolio.”

“LAMF is perfect for professionals like me with variable cash flows. I use the overdraft when needed and pay interest only on the amount I use. It’s like having financial freedom on standby.”

If you're looking to avail a loan against mutual funds, it's important to know which Asset Management Companies (AMCs) are eligible for lien marking and pledge under this facility. At DhanLAP, we work with a broad network of SEBI-registered AMCs to help you unlock the value of your investments without having to redeem them.

You can avail a loan against mutual funds for schemes managed by the following eligible AMCs: