Hybrid

Multi Asset Allocation

Very High

Investment Returns (CAGR)

1 yr.

17.77

3 yr.

13.56

5 yr.

10.99

Since Inception.

7.6%

Fund Size (Rs.)

881 Cr

Exit Load

Exit load of 1% if units in excess of 10% are redeemed or switched-out within 12 months

Scheme Type

Dividend

ISIN

INF789F01VC0

Expense Ratio

1.07%

Minimum SIP (Rs.)

500

Launch Date

01-Jan-2013

Fund House

UTI Mutual Fund

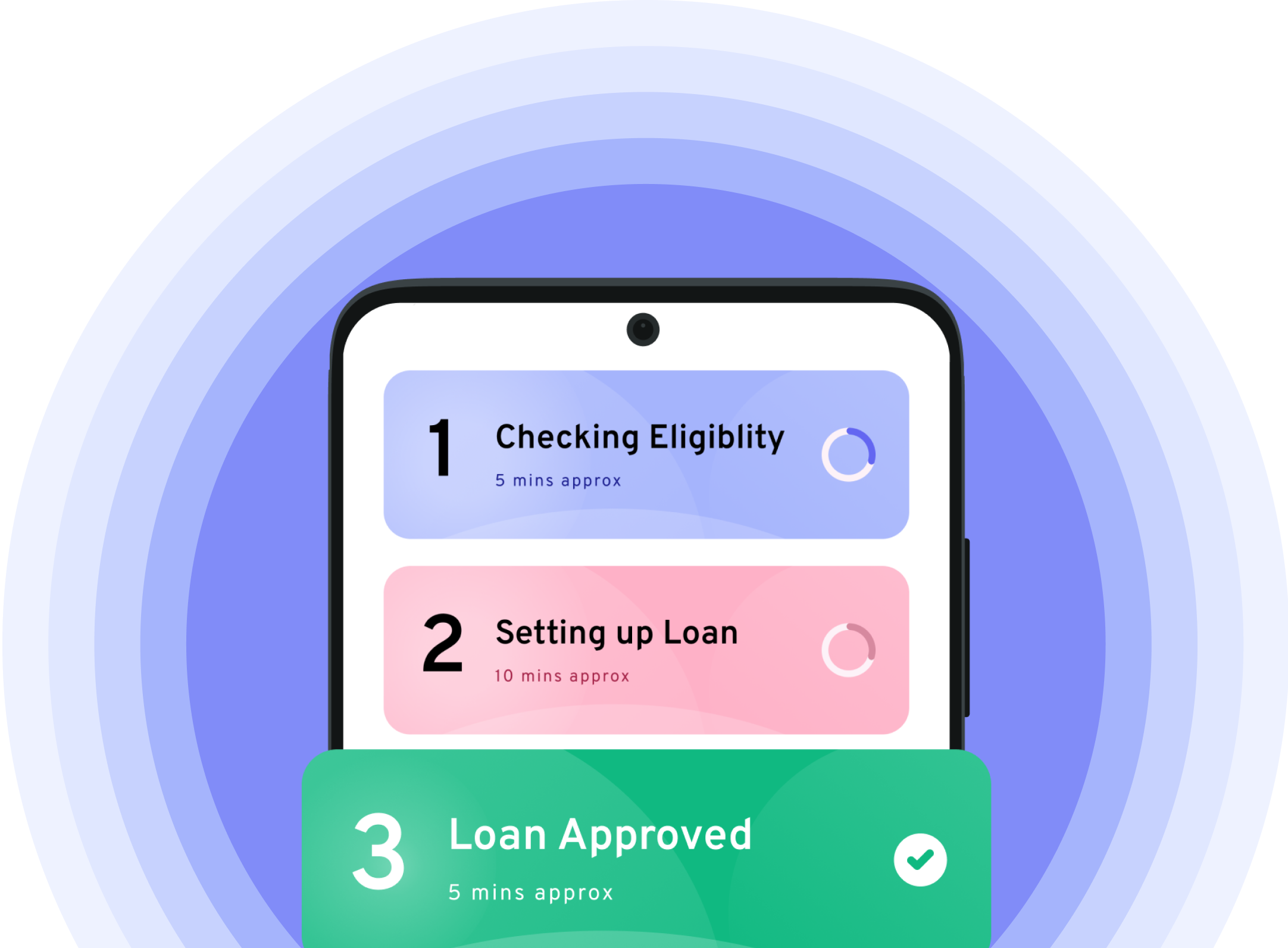

Balloon Payment

(Interest only)

Pay monthly installments towards interest only. Settle the principal at the end of tenure.

The Scheme seeks to achieve long term capital appreciation by investing predominantly in a diversified portfolio of equity and equity related instruments. The fund also invests in debt and money market instruments with a view to generate regular income. The fund also invests in Gold ETFs. The portfolio allocation is managed dynamically. ;

Hybrid

Multi Asset Allocation

Very High

Fund Size (Rs.)

881 Cr

Benchmark Index

----

Scheme Type

Dividend

ISIN

INF789F01VC0

Expense Ratio

1.07%

Minimum SIP (Rs.)

500

Launch Date

01-Jan-2013

Fund House

UTI Mutual Fund

Exit Load

Exit load of 1% if units in excess of 10% are redeemed or switched-out within 12 months

1 yr. 17.77

3 yr. 13.56

5 yr. 10.99

Since Inception. 7.6%

Balloon Payment

(Interest only)

Pay monthly installments towards interest only. Settle the principal at the end of tenure.

The Scheme seeks to achieve long term capital appreciation by investing predominantly in a diversified portfolio of equity and equity related instruments. The fund also invests in debt and money market instruments with a view to generate regular income. The fund also invests in Gold ETFs. The portfolio allocation is managed dynamically. ;