Hybrid

Dynamic Asset Allocation

Moderately High

Investment Returns (CAGR)

1 yr.

8.49

3 yr.

13.09

5 yr.

11.82

Since Inception.

11.0%

Fund Size (Rs.)

1527 Cr

Exit Load

For units in excess of 25% of the investment,1% will be charged for redemption within 365 days

Scheme Type

Growth

ISIN

INF173K01FI7

Expense Ratio

0.59%

Minimum SIP (Rs.)

100

Launch Date

02-Jan-2013

Fund House

Sundaram Mutual Fund

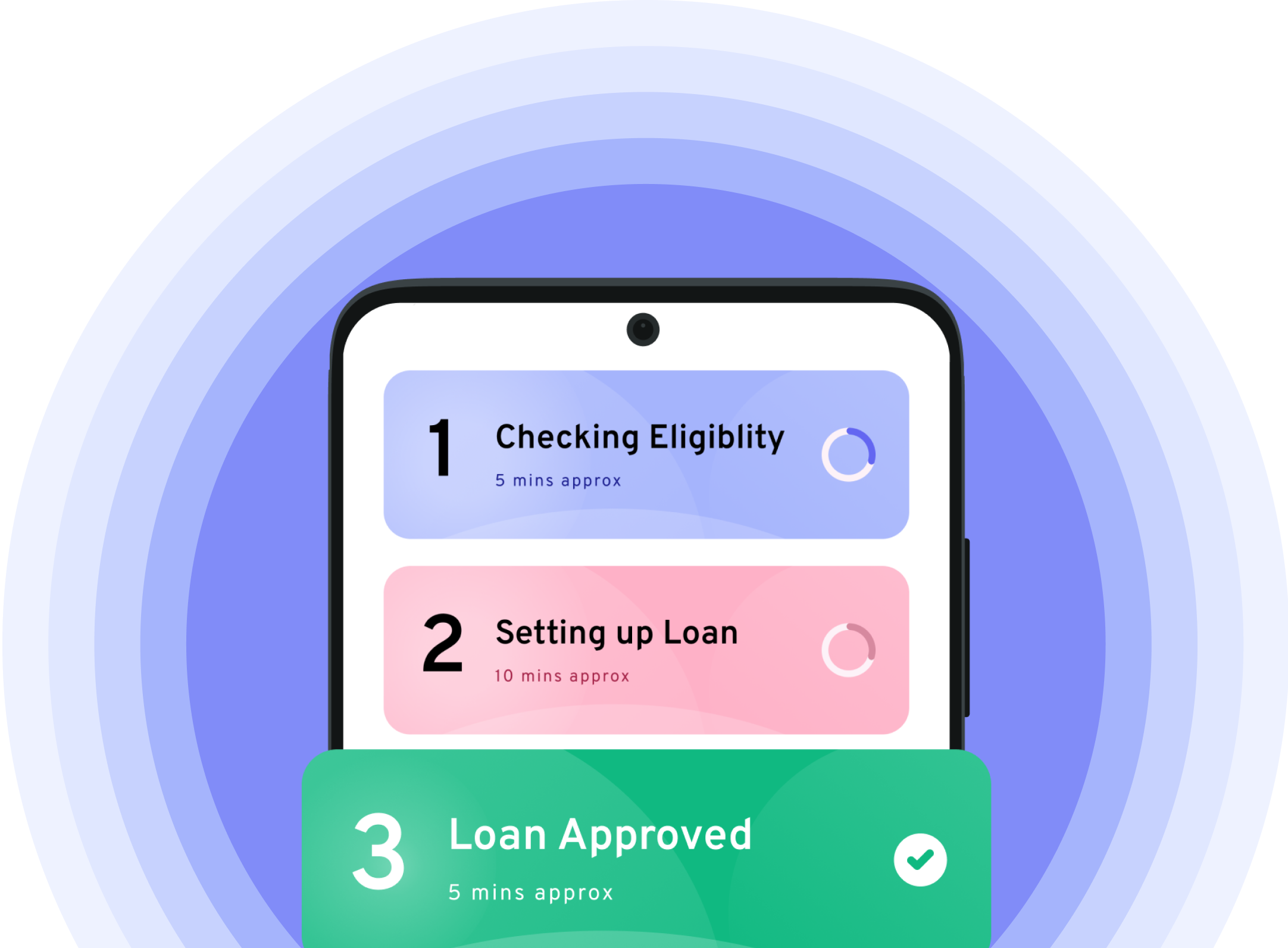

Balloon Payment

(Interest only)

Pay monthly installments towards interest only. Settle the principal at the end of tenure.

The scheme seeks to generate long term capital appreciation with relatively lower volatility by allocation of funds into equity assets based on Price Earning Ratio (PE Ratio) levels. When the markets become expensive in terms of 'Price to Earnings' Ratio'; the scheme will reduce its allocation to equities and move assets into debt and/or money market instruments and vice versa. ;

Hybrid

Dynamic Asset Allocation

Moderately High

Fund Size (Rs.)

1527 Cr

Benchmark Index

----

Scheme Type

Growth

ISIN

INF173K01FI7

Expense Ratio

0.59%

Minimum SIP (Rs.)

100

Launch Date

02-Jan-2013

Fund House

Sundaram Mutual Fund

Exit Load

For units in excess of 25% of the investment,1% will be charged for redemption within 365 days

1 yr. 8.49

3 yr. 13.09

5 yr. 11.82

Since Inception. 11.0%

Balloon Payment

(Interest only)

Pay monthly installments towards interest only. Settle the principal at the end of tenure.

The scheme seeks to generate long term capital appreciation with relatively lower volatility by allocation of funds into equity assets based on Price Earning Ratio (PE Ratio) levels. When the markets become expensive in terms of 'Price to Earnings' Ratio'; the scheme will reduce its allocation to equities and move assets into debt and/or money market instruments and vice versa. ;