Other

FoF Overseas/Domestic

Very High

Investment Returns (CAGR)

1 yr.

3.06

3 yr.

-9.06

5 yr.

-2.58

Since Inception.

1.8%

Fund Size (Rs.)

115 Cr

Exit Load

0.5% for redemption within 90 days

Scheme Type

Growth

ISIN

INF223J01NL0

Expense Ratio

0.57%

Minimum SIP (Rs.)

1000

Launch Date

01-Jan-2013

Fund House

PGIM India Mutual Fund

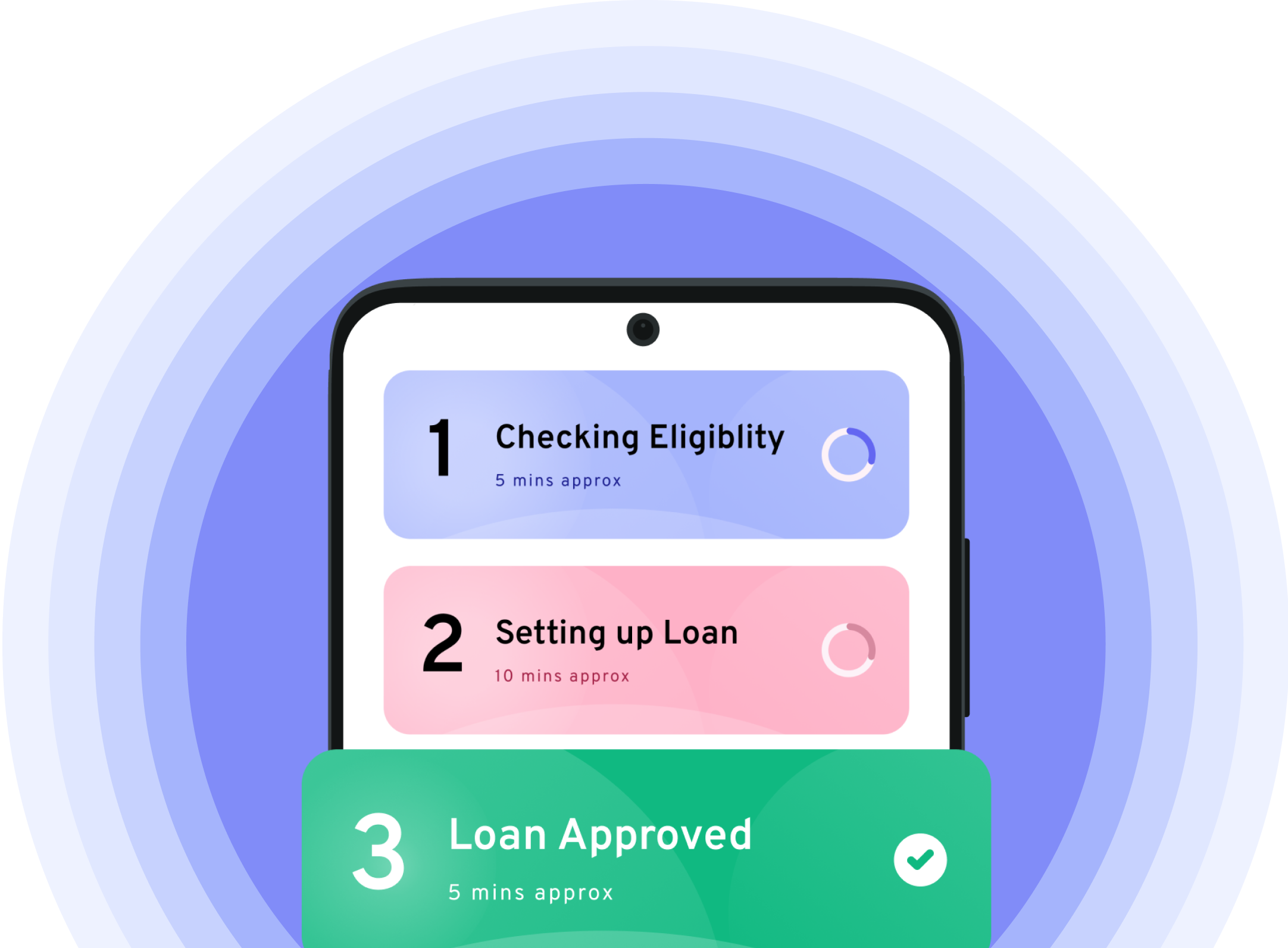

Balloon Payment

(Interest only)

Pay monthly installments towards interest only. Settle the principal at the end of tenure.

The fund invests in equities of issuers with headquarter in a member state of the European economic and monetary union(EMU). The fund management tries to identify current & future market leaders while putting special emphasis on the companies' structural growth and earnings momentum characteristics. Although the fund the primarily invests in large caps; small & mid caps can make up 30% of the fund assets. ;

Other

FoF Overseas/Domestic

Very High

Fund Size (Rs.)

115 Cr

Benchmark Index

----

Scheme Type

Growth

ISIN

INF223J01NL0

Expense Ratio

0.57%

Minimum SIP (Rs.)

1000

Launch Date

01-Jan-2013

Fund House

PGIM India Mutual Fund

Exit Load

0.5% for redemption within 90 days

1 yr. 3.06

3 yr. -9.06

5 yr. -2.58

Since Inception. 1.8%

Balloon Payment

(Interest only)

Pay monthly installments towards interest only. Settle the principal at the end of tenure.

The fund invests in equities of issuers with headquarter in a member state of the European economic and monetary union(EMU). The fund management tries to identify current & future market leaders while putting special emphasis on the companies' structural growth and earnings momentum characteristics. Although the fund the primarily invests in large caps; small & mid caps can make up 30% of the fund assets. ;