Debt

Credit Risk

High

Investment Returns (CAGR)

1 yr.

8.55

3 yr.

9.27

5 yr.

4.84

Since Inception.

7.1%

Fund Size (Rs.)

1018 Cr

Exit Load

Exit load of 1% if units in excess of 10% are redeemed within 12 months

Scheme Type

Dividend

ISIN

INF204K01A82

Expense Ratio

0.91%

Minimum SIP (Rs.)

100

Launch Date

31-Dec-2012

Fund House

Nippon India Mutual Fund

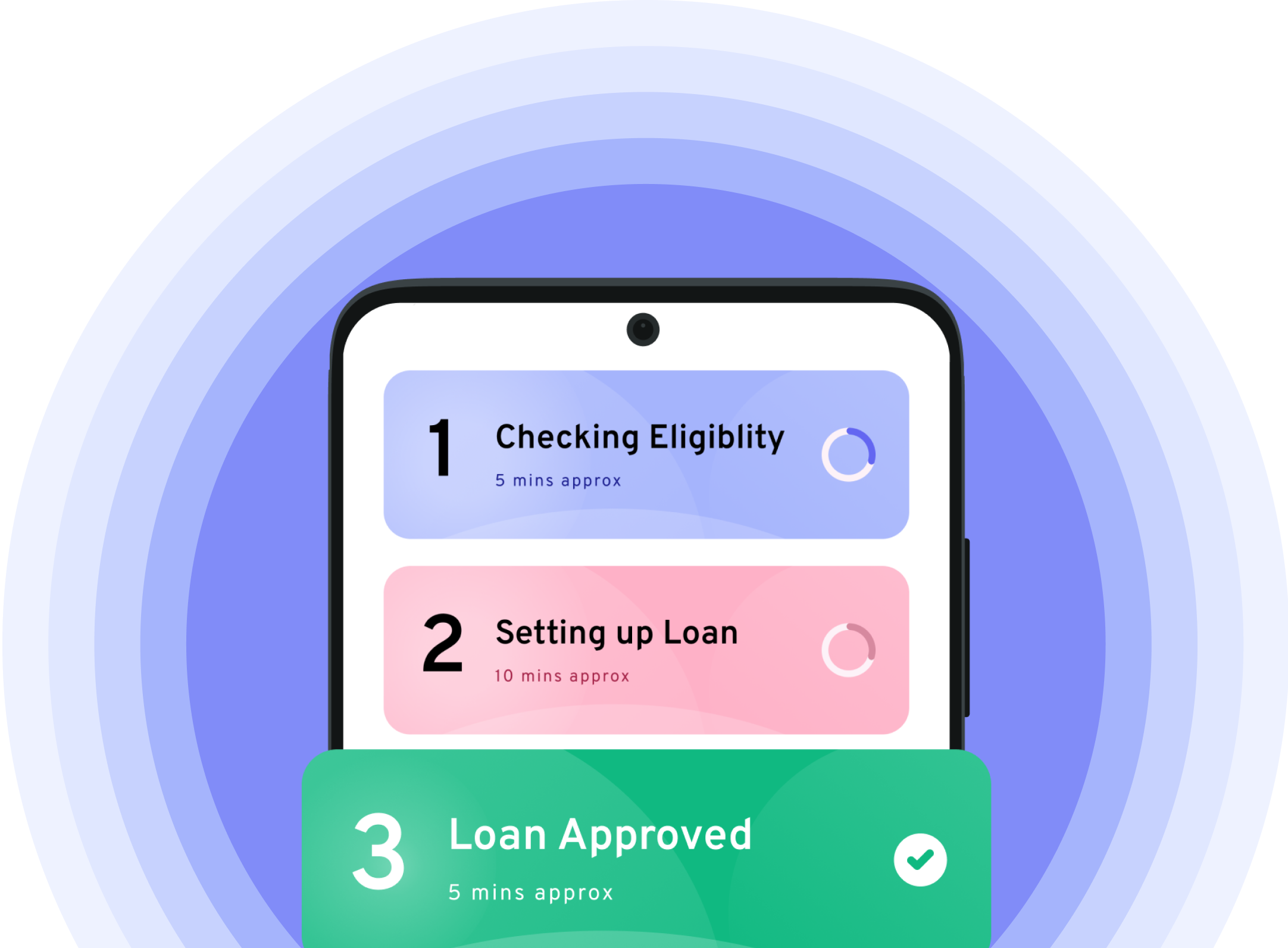

Balloon Payment

(Interest only)

Pay monthly installments towards interest only. Settle the principal at the end of tenure.

The scheme aims to generate optimal returns consistent with moderate levels of risk. It will invest atleast 65 per cent of its assets in debt instruments with maturity of more than 1 year and the rest in money market instruments (including cash or call money and reverse repo) and debentures with maturity of less than 1 year. The exposure in government securities will generally not exceed 50 percent of the assets. ;

Debt

Credit Risk

High

Fund Size (Rs.)

1018 Cr

Benchmark Index

----

Scheme Type

Dividend

ISIN

INF204K01A82

Expense Ratio

0.91%

Minimum SIP (Rs.)

100

Launch Date

31-Dec-2012

Fund House

Nippon India Mutual Fund

Exit Load

Exit load of 1% if units in excess of 10% are redeemed within 12 months

1 yr. 8.55

3 yr. 9.27

5 yr. 4.84

Since Inception. 7.1%

Balloon Payment

(Interest only)

Pay monthly installments towards interest only. Settle the principal at the end of tenure.

The scheme aims to generate optimal returns consistent with moderate levels of risk. It will invest atleast 65 per cent of its assets in debt instruments with maturity of more than 1 year and the rest in money market instruments (including cash or call money and reverse repo) and debentures with maturity of less than 1 year. The exposure in government securities will generally not exceed 50 percent of the assets. ;