Equity

Sectoral / Thematic

Very High

Investment Returns (CAGR)

1 yr.

29.03

3 yr.

38.9

5 yr.

22.19

Since Inception.

13.6%

Fund Size (Rs.)

2531 Cr

Exit Load

Exit load of 1% if redeemed less than 12 months

Scheme Type

Growth

ISIN

INF740K01PU7

Expense Ratio

1.2%

Minimum SIP (Rs.)

100

Launch Date

01-Jan-2013

Fund House

DSP Mutual Fund

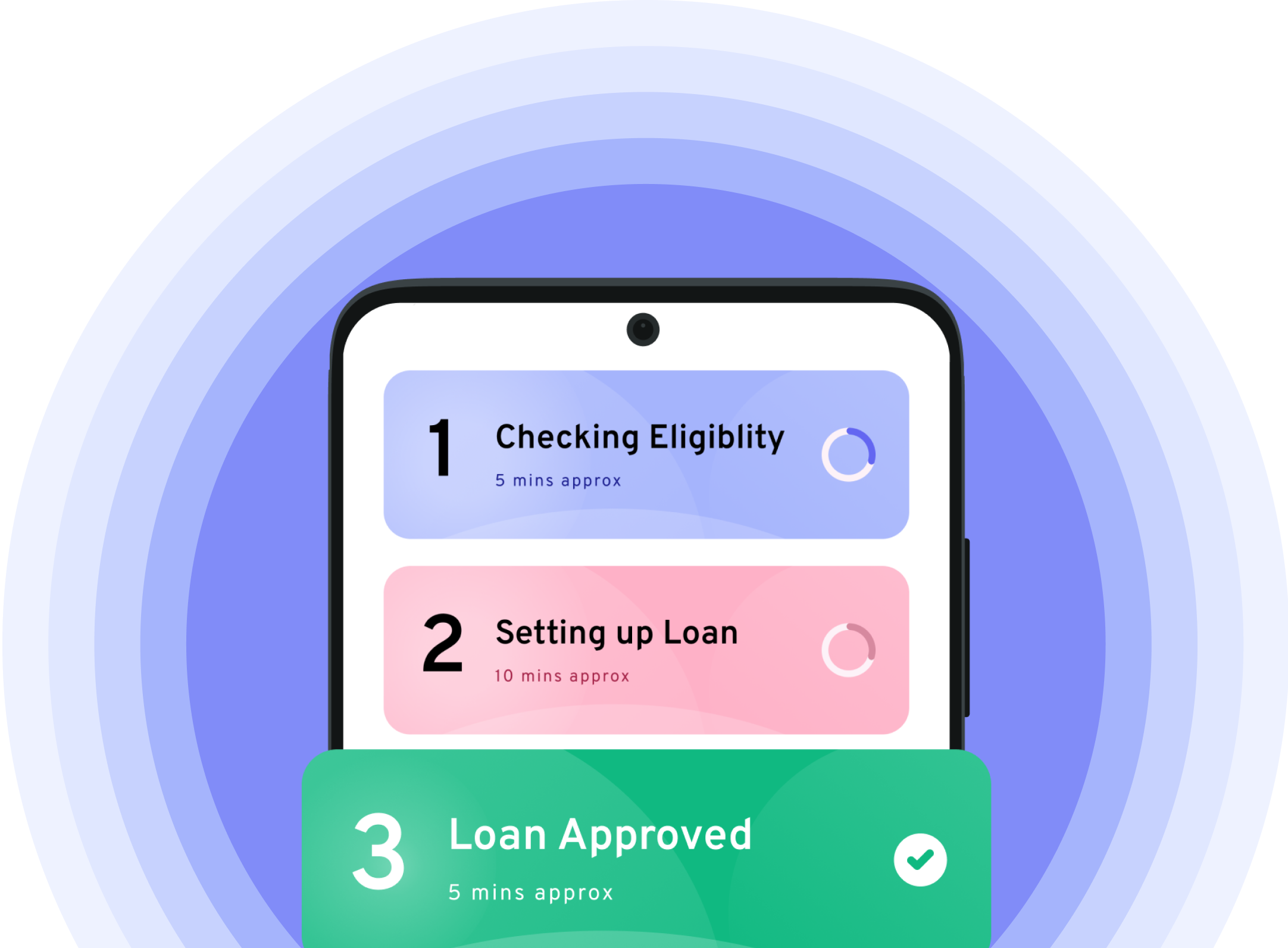

Balloon Payment

(Interest only)

Pay monthly installments towards interest only. Settle the principal at the end of tenure.

The fund seeks to generate capital appreciation by investing in equity and equity related securities of corporates that could benefit from ongoing structural changes and economic reforms in the country. The portfolio is well diversified across sectors, market capitalisation and between private & PSU companies and will get benefit from increased government spending on infrastructure and increased private participation and revival in the corporate capex cycle. ;

Equity

Sectoral / Thematic

Very High

Fund Size (Rs.)

2531 Cr

Benchmark Index

----

Scheme Type

Growth

ISIN

INF740K01PU7

Expense Ratio

1.2%

Minimum SIP (Rs.)

100

Launch Date

01-Jan-2013

Fund House

DSP Mutual Fund

Exit Load

Exit load of 1% if redeemed less than 12 months

1 yr. 29.03

3 yr. 38.9

5 yr. 22.19

Since Inception. 13.6%

Balloon Payment

(Interest only)

Pay monthly installments towards interest only. Settle the principal at the end of tenure.

The fund seeks to generate capital appreciation by investing in equity and equity related securities of corporates that could benefit from ongoing structural changes and economic reforms in the country. The portfolio is well diversified across sectors, market capitalisation and between private & PSU companies and will get benefit from increased government spending on infrastructure and increased private participation and revival in the corporate capex cycle. ;